JAWX (*Updated JAN 01 2021)

TOTAL STOCK RATIO: 35%

VT: WORLD MARKET, VT holding at 27%

This ETF aims on the global market. Not focused on one country, but it's global. However, this holds about 56.9% US market, and its because US is by far, biggest market in the world. China, it's about 5.3%. But, since the Commie Chinese are claiming, Hong Kong (0.9%) and Taiwan (1.8%) as one China, it can be 8%, but I will put it at 6.2% China.

I put EWC (Canada), INDA (India), EIDO (Indonesia), and VWO (Emerging Market, that holds lot of China market, but not 100%)

EWC, Canada (1%): I put 1% of Canada in several reasons.

noticed bank holdings? that is not the main reason. Shopify, Rail companies, Barrick gold (they also mine coppers).

global warming helps Canadians to explore the icy areas of their country, need lot's of money to borrow to explore. also, their northern islands are newly discovered after the massive ice melting, it will help Canadians to expand their population further more towards to North side, and they need more rails to carry mining items, and cargos. it's like United States back in wild wild west.

INDA, India (1%): 1% in India. Why India? they are 2nd largest populated country in the world. GDP growth rate is steep, lot's of new innovative companies are popping up like crazy. But, my main reason is because they are one of the biggest haters of China. before the USSR failed. Which country got the most support from the US? China. For same reason, US is going to support India and India will/ and they are buying US weapons. I see a potential on India Market.

(Source: https://foreignassistance.gov/)

they are one of the chain country to isolate China. it connects, Japan, to Taiwan, to Philippines (they are turning to China), Indonesia, and India. Since the Philippines are turning towards to China over US, EIDO might be benefiting from aids from US.

(Source: https://foreignassistance.gov/)

VWO, the Emerging Market (3%): holding shows lots of Chinese companies. it seems a bit risky approach, But it has potential of growth. the Holding's biggest holding is BABA 6.52% (Alibaba listed in NYSE). other holdings are Taiwan, South Africa and few more Emerging markets. While the Dollar weakens, the Global market do well. Less Value of USD, Cheaper for Emerging Market to borrow money to purchase/ invest. We are on monetary policy 3, Low interest + QE. I expect USD value will continue decline to 85-80 point range (12/26/2020 at 90.22) Doesn't mean the USD is dying. means it's cheaper for the emerging market to Borrow. will Explain more on Bond side, EMLC.

(Source: https://whalewisdom.com/filer/bridgewater-associates-inc#tabholdings_tab_link)

Bridgewater's 13F 9/30/2020 reports shows, EEM, Emerging Market etf, increased 232% makes it 8th largest hold in their portfolio. EEM holdings are very similar to the VWO (Samsung is one huge different I see). with the exp ratio of 0.68% vs 0.1% on VWO.

VTI, Total US stock Market, AKA MEGA America! (2%):

I would hold just 1% and the price of this ETF went up way too high, 1% can't hold proper ratio I need to bring. the Price is at $192 range on 12/26/2020. It's American market and by far it has best performed since the 2008 Market crash. Top holds are; AAPL, MSFT, AMZN, FB, GOOGL, BRK, TSLA, JNJ, and JPM. these are the ones that controls the world market. VT already holds all this companies, and let's focus more in just US market by 2%

BOND: 53.5%

There are few different types of Bonds, but let's focus on key things: US govt issued bond, Corporate, Municipal, Foreign Country issued Bond, Inflation bonds that, tied up with the CPI rate.

EDV, VCLT, MUB, EMLC, TIP, and LTPZ total holds 53.5% of the JAWX.

EDV, US govt 17%: it's a unique bond compare to TLT. bit more volatile than the TLT, but it's a Zero Coupon bond. means the bond is purchased and managed by Vanguard lower than the actual bond. (ex. 30yr $100 bond with 3% will cost $100 to buy. Zero coupon will cost somewhere around $67~72 range. pay less to own it and it's worth $100 30 years later. simply not getting interest (coupon). and what is the benefit of EDV over TLT? the expense ratio on EDV, 0.07% with 1.98%yd. TLT, 0.15% expense ratio with 1.56%yd.

so do the math, EDV is way better deal.

VCLT, Corporate 7.5%: corporate bond holding that contains, BBB rating and up. expense ratio is 0.05% and 3.24%yd.

MUB, Municipal bond 2%: it's 0.07% exp with 2.18%yd. This one is a boring bond that holds, your city or village issued bond. little better than the EDV yd, but the reason I hold this rather than more EDV is for the TAX. MUB bond is tax exempt, and it's not much, but you will get some tax cut. Plus, our govt money printer owns lot's of Municipal bonds.

EMLC, the Emerging Market Bond 7.5%: Can't just relying on US Bond. our interest rate is almost at 0% and very slim or 0% chance will go below 0, - side. there are potential risk bond market crash due to increased interest rate by the Fed. EMLC is emerging market's bond that pays 5.27%yd with 0.3% expense. remember from the VWO side, cheaper to Borrow $. means easier to pay back the loan. Risk of default on this emerging market just went down.

TIP and LTPZ, together 19.5%. these are the inflation bond. TIP AUM is much higher 24.5B. LTPZ is at 724M. honestly, either one should be fine, but if I have to pick one, TIP is much safer to stay with. But, I am holding both since they are basically same inflation protected bonds. TIP 1.23% yd VS LTPZ 1.94%, 0.7% more yield, but AUM is difference between B and M.

GOLD: 6%

Ray Dalio's All weather says 7.5% gold. I hold 6%. 1.5% ganna make big difference? may be.. Warren Buffet says gold doesn't do anything, but shines. Ken Fisher says, gold performance is not so great 80% of the time. but, when it performs in 20% of the time, it performs really well.

My thought on gold? the recent Crypto currency's recognition as holding asset value, gold performance might be acting slower than what it used to be. however, it was the most secure way to hold your wealth last 5000yrs.

JPM's silver game indicates, silver is another metal we all should own.

personally, I like to own the physical gold than the digital gold. 6% is enough for easy trades, but I own the real gold. (GLD is managed by HSBC in England, and check their Stock, IAU is under JPM's management in USA)

COMMODITY: 4%

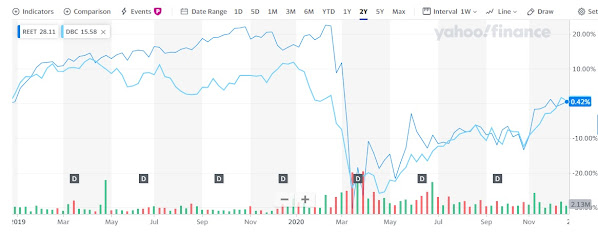

XLB and DBC 2% each. DBC is easiest way to own commodity. GOLD, SILVER, OIL, SOYB, Coffee, and more are under DBC. DBC exp ratio is 0.85% with 2%yd. XLB is material etf 0.13% exp with 1.71% yd. I simply can't agree pay 0.85% fee alone. I split commodity in two groups, and more exposure to the stock part, but XLB is material sector.

REIT: 1.5%

REIT aka, real estate. I included on all weather because of the commodity is only at 4%. I own it under REET, global reit. means, another exposure to stock market. land price will move along with the inflation and 5.6% yd with 0.14%exp was very attractive deal to own. Stock pattern is showing very similar path as DBC, and I think REET can be replacing DBC's crazy high expense ratio of 0.85%. plus, how many people won't own a land in their life time? real estate is something you will end up owning in future or you already own it.

No comments:

Post a Comment